Secured

PCI DSS, Level 1

Regulated

Visa Principal member

Licensed

Extern Financial Supervisory Authority

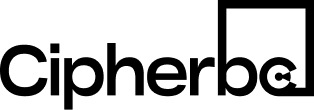

What is CipherBC’s White Label Card

A ready-to-deploy platform that allows you to issue physical or virtual payment cards carrying your name, logo, and design while all the complex infrastructure runs in the background.

Customers can instantly spend stored value anywhere major payment networks are accepted, with transactions processed and authorized in real time.

All KYC, AML, reporting, and settlement requirements are fully managed by our licensed partners so you can operate without building your own regulatory setup.

Designed to support multiple currencies, varied transaction limits, and regional onboarding flows, giving you flexibility to scale across jurisdictions.CipherBC is a licensed and compliant wealth platform for digital assets.

This is not a standalone card product that competes with your brand — every transaction and interaction remains tied to your customer ecosystem.

No need to negotiate directly with banks or payment networks or invest

heavily in building card issuance systems from

scratch.

Regulatory obligations, fraud monitoring, and data security are built into the program and handled by a team already operating in regulated markets.

The program can be tailored to your brand identity, business logic, and customer experience — from card appearance to transaction rules.

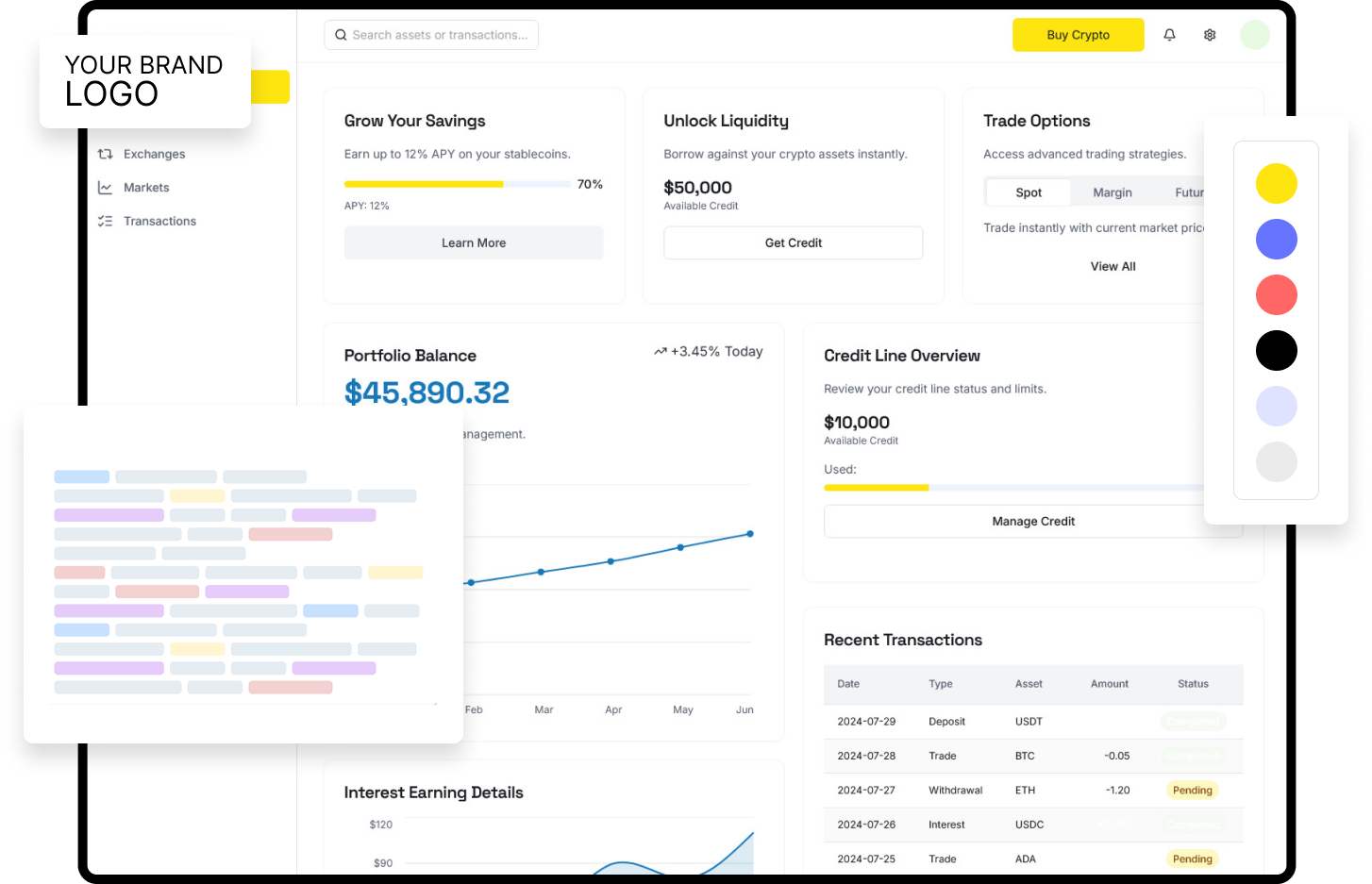

How the Platform Works

CipherBC’s platform connects your customer balances directly to global payment networks through a fully managed issuing and settlement framework. Every transaction is authorized in real time, compliance is handled end-to-end, and the entire program runs under your brand.

Instant Conversion

Compliance Covered

Customer spends using a physical or virtual card, triggering an

instant authorization against

their stored balance.

Every user is verified through fully managed KYC and AML workflows,

removing the burden from your

internal teams.

Funds are converted to the settlement currency at the time of

purchase with no delay in

transaction approval.

Transactions are monitored for compliance and fraud risk, with full

audit trails and reporting

delivered to you.

The payment is processed through major networks while all records

and brand touchpoints remain

yours.

Settlements are processed in multiple jurisdictions, enabling you to

serve customers across

borders without additional infrastructure.

Why the Platform Delivers Strategic Value

Increase Retention

Keep customers engaged by giving them a reason to transact within your ecosystem daily.

Capture More Revenue

Every spend event becomes a revenue opportunity for your business.nts.

Strengthen Brand Presence

Your name is in customers’ wallets and visible at every point of sale.

Expand Globally

Instant access to global payment networks without building infrastructure.

How it can be customized

From card design to transaction rules, every element can reflect your brand’s identity and operational strategy.

Custom card artwork and packaging.

Choice of supported settlement currencies.

Adjustable transaction limits per user tier.

Integration with your mobile or web app.

Branded customer support touchpoints.

Tailored onboarding flows for different markets.

Not finding the custom solution you’re looking for?

Reach out to our White Label team.

Pre-Built Program Models for

High-Demand Scenarios

We’ve designed ready-to-launch program templates based on proven transaction

patterns. These save months of

development and testing, allowing you to start serving customers immediately.

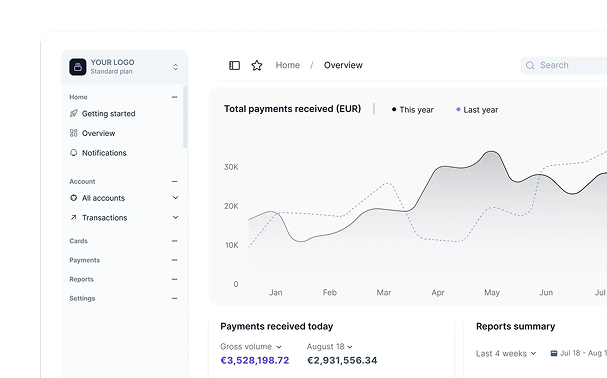

Digital Asset Platforms

Creative DirectorEnable users to instantly convert and spend their stored value anywhere major payment networks are accepted, keeping all transactions tied to your platform without sending funds elsewhere.

Retail Brands

Launch a store-linked payment card that rewards loyalty, drives repeat purchases, and allows customers to use stored balances both online and in-store without third-party intermediaries.

Financial Institutions

Expand your product portfolio with a fully branded card program that gives customers a seamless way to access and spend account balances globally, with compliance and operations fully managed.

Gaming and Entertainment

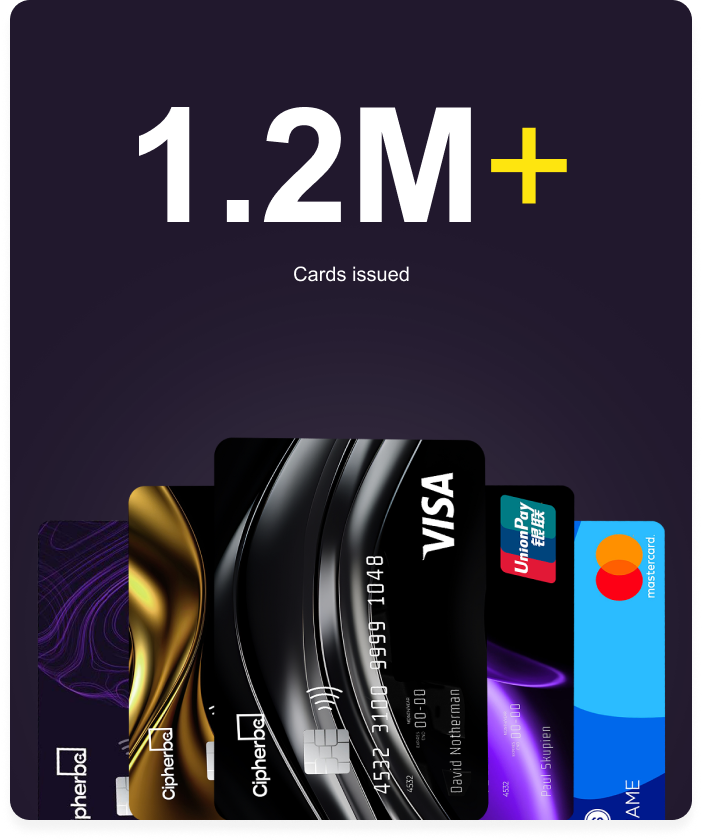

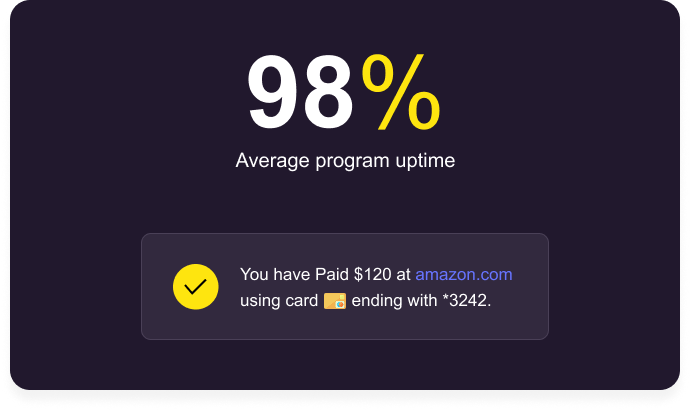

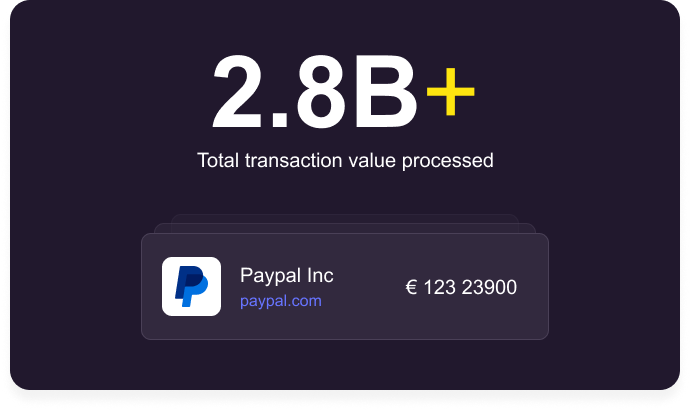

Offer players a direct way to spend winnings, rewards, or balances in real-world transactions, while keeping every payment under your brand and within your controlled ecosystem.CipherBC in Numbers

Get Your Program Live

Without the Build Time

We have the compliance, licensing, and technology in place —

you bring

the brand and customers.

Steps to Activate Your Branded Card

1. Program Planning

We define card features, branding elements, and operational parameters.

2. Compliance Onboarding

Customers are verified through fully managed KYC and AML processes.

3. Integration

We connect your platform to our issuing and settlement infrastructure.

4. Go Live

Cards are shipped or issued digitally, ready for immediate use.

Frequently Asked Questions

Do we need our own licenses?

No. The program operates under our licensed network of issuing banks and compliance partners, meaning you can launch without building your own licensing infrastructure. All KYC, AML, and reporting requirements are covered, ensuring your program remains compliant in every supported market.

Can the card be used internationally?

Yes. You control the card’s visual design, packaging, and customer touchpoints. Beyond physical appearance, you can also define spending rules, supported currencies, rewards logic, and onboarding flows so the program feels like an extension of your existing platform.

What settlement currencies are supported?

Our network supports issuance across multiple jurisdictions with localized onboarding and currency settlement. Whether you’re targeting one country or a global customer base, the platform can adapt to regional compliance and transactional requirements without separate builds.

How customizable is the user experience?

Revenue can be generated from multiple sources including interchange fees, FX margins, and increased customer retention. Since the program keeps users transacting within your ecosystem, you also gain indirect value through higher lifetime spend and reduced churn.